Having a Permanent Account Number (PAN) is essential for financial transactions in India. It acts as a unique identification number for taxpayers and is mandatory for banking, investments, loans, and income tax filing.

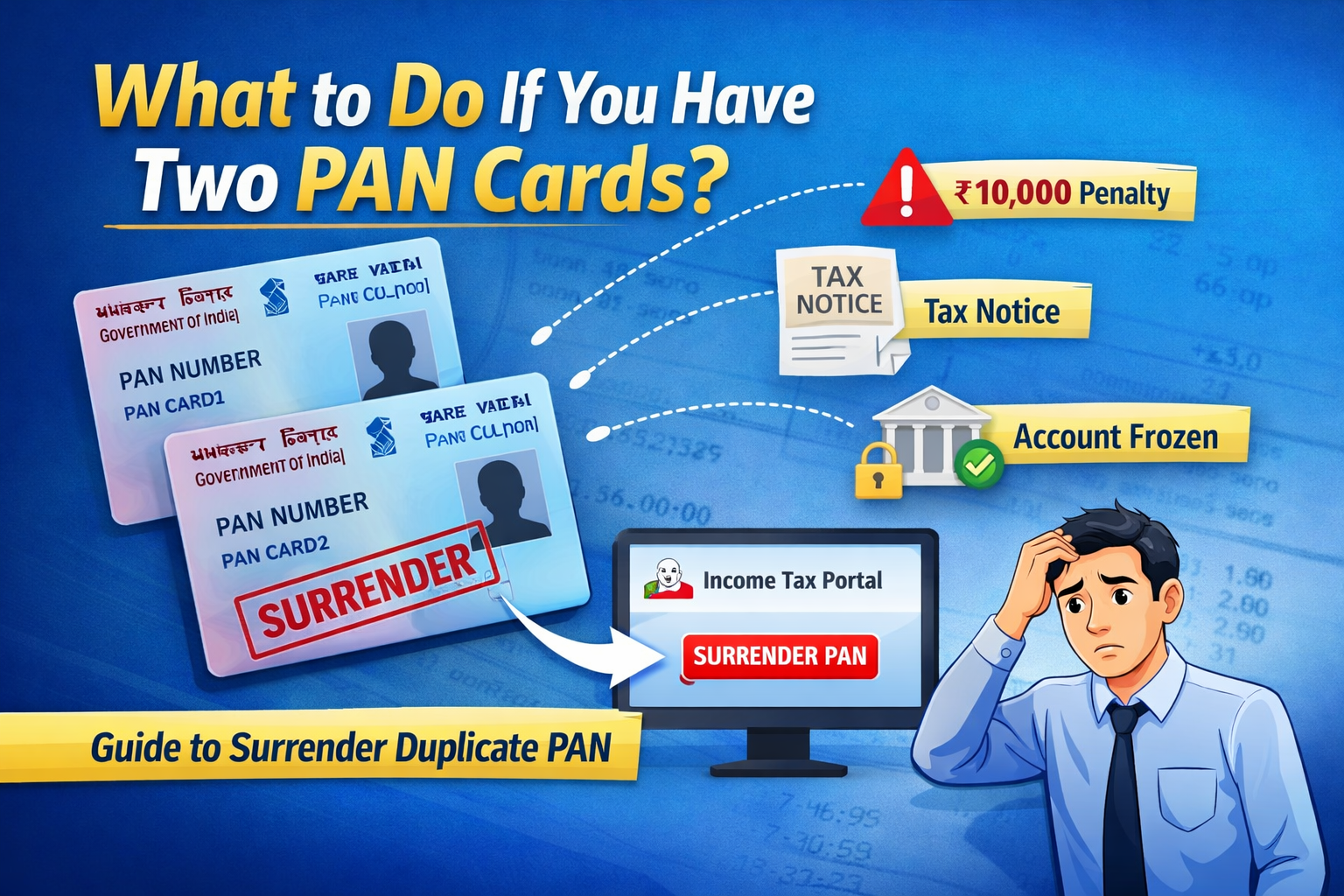

However, many people unknowingly end up with two PAN cards due to mistakes during application, name changes, or duplicate submissions. If you are in this situation, don’t panic — but it is important to take action quickly.

In this article, we’ll explain what happens if you have two PAN cards, the penalties involved, and how to surrender a duplicate PAN step-by-step.

Can a Person Have Two PAN Cards?

No. As per rules of the Income Tax Department, one individual is allowed to hold only one PAN number.

If someone possesses more than one PAN in their name, it is considered a violation under the Income Tax Act.

Why Do People End Up With Two PAN Cards?

There are several common reasons:

Applying for PAN multiple times by mistake

Change in name after marriage and applying again instead of correction

Errors in date of birth or spelling leading to re-application

Applying through different agents or portals without checking status

Most cases are genuine mistakes, but they still need correction.

What Happens If You Have Two PAN Cards?

Holding multiple PAN cards can create serious financial and legal complications.

- Penalty Under Income Tax Law

Under Section 272B of the Income Tax Act, authorities may impose a penalty of ₹10,000 for holding more than one PAN. - PAN Deactivation Risk

The department may deactivate one PAN. In some cases, both numbers may be flagged for verification. - Income Tax Filing Problems

You may face:

TDS credit mismatch

Issues in Form 26AS or AIS

Income tax notices

Difficulty in filing returns - Banking and Loan Issues

Since PAN is mandatory for KYC:

Bank accounts may get restricted

Loan approvals may get delayed or rejected

Investment accounts may face compliance issues

Which PAN Should You Keep?

You should retain the PAN that:

Is linked with Aadhaar

Has been used for Income Tax Return (ITR) filing

Is registered with your bank and financial accounts

The other PAN must be surrendered.

How to Surrender Duplicate PAN Online (Step-by-Step)

The easiest way to surrender a PAN is through the Income Tax portal.

Step 1: Visit the Portal

Go to the Income Tax e-filing website.

Step 2: Login

Login using the PAN you want to keep active.

Step 3: Navigate to Services

Go to: Services → PAN → Surrender Duplicate PAN

Step 4: Enter Details

Provide:

PAN number to surrender

Reason for surrender

Step 5: Submit Request

Submit the form and download the acknowledgement for future reference.

How to Surrender Duplicate PAN Offline

You can also surrender PAN physically through authorized centers like:

NSDL

UTIITSL

Offline Process:

Fill PAN correction form

Mention both PAN numbers clearly

Tick option for “Surrender duplicate PAN”

Attach copies of both PAN cards

Submit at the center and collect acknowledgement

Important Things to Do After Surrender

After surrendering duplicate PAN:

Update correct PAN in bank accounts

Inform employer and financial institutions

Ensure Aadhaar is linked with active PAN

Use only one PAN for all transactions

This prevents future compliance issues.

How Long Does PAN Surrender Take?

Usually, the process takes 15 to 30 days depending on verification by authorities.

Final Thoughts

Having two PAN cards is a common mistake, but ignoring it can lead to penalties and financial complications. The good news is that surrendering a duplicate PAN is a simple process if done promptly.

Always ensure you use only one PAN for all financial and tax purposes to avoid legal trouble.

Frequently Asked Questions (FAQs) - Is it illegal to have two PAN cards?

Yes. A person is legally allowed to hold only one PAN. Having multiple PAN cards can attract penalties. - What is the penalty for duplicate PAN?

The penalty can be up to ₹10,000 under Section 272B of the Income Tax Act. - Can I keep both PAN cards if details are different?

No. Even if details vary slightly, only one PAN should remain active. - How do I know which PAN is active?

Check which PAN is linked with Aadhaar, used for ITR filing, and registered with banks. - Do I need to surrender PAN if I never used it?

Yes. Even unused duplicate PAN should be surrendered to avoid future issues. - Can banks freeze accounts due to two PAN numbers?

Yes, banks may restrict accounts if PAN discrepancies are found during KYC verification. - Is surrendering PAN free?

Online surrender through the Income Tax portal is generally free. Offline services may involve minor charges.